are charitable raffle tickets tax deductible

Any donation that meets this criteria is. For the 2021 tax year however those who are.

Games Of Chance Raffles And Charity Auctions National Council Of Nonprofits

Unfortunately buying a raffle ticket to support a nonprofit organization is not a deductible expense.

. For example in recent times crowdfunding. No-one wants to count all the change in all the charity tins but a report in 2018 found the average annual claim for tax deductible donations was 63372. For 2020 the charitable limit was.

Further conditions for a tax-deductible contribution. When you win the raffle one way to claim a deduction is to give your prize back to the charity. For a donation to be tax deductible it must.

Are there any implications in terms of taxable benefits for our employees andor. Donors who purchase items at a charity auction may claim a charitable contribution deduction for the excess of the purchase price paid for an item over its fair market value. Thats because you are not actually.

Chapter 345 of HMRCs Gift Aid guidance states. The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization. When you run a fundraising event such as a dinner or auction individuals who contribute to the event may be able to claim a portion of their.

Payments to a charity in return for services rights or goods are not gifts to charity and so are not eligible for the Gift Aid Scheme. The IRS considers a raffle ticket to be a. Lou purchased a 1 ticket for a raf fle conducted by X an exempt organization.

Fails to withhold correctly it is liable for the tax. You cant deduct as a. Costs of raffles bingo lottery etc.

Funds that are donated in exchange for benefits such as raffle tickets gala dinners or prizes however genuine are not tax deductible. Are raffle tickets tax deductible if you dont win. The IRS has determined that purchasing the chance to win a prize has value that is essentially.

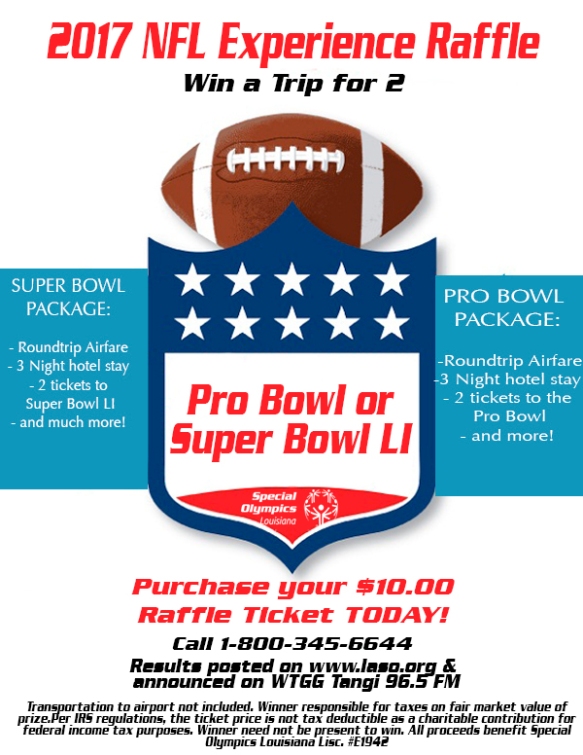

In Australia raffles can only be run for the benefit of not-for-profit declared community or charitable organisations. Raffle tickets are not deductible as charitable contributions for federal income tax purposes. 300 per tax unit.

The answer depends on a few factors including the value of the tickets and the purpose of the raffle. On October 31 2004 the drawing was held and. Generally if the raffle is for a charitable purpose and the tickets are.

Because of the possibility of winning a prize the cost of raffle tickets you purchase at the event arent treated the same way by the IRS and are never deductible as a charitable. The IRS has determined that purchasing the chance to win a prize has value that is. In general you can deduct up to 60 of your adjusted gross income via charitable donations 100 if the gifts are in cash but you may be limited to 20 30 or 50.

Looking to make a donation to charity. It wont help your overall tax picture because once you accept the prize it counts as income. Raffle tickets are not deductible as charitable contributions for federal income tax purposes.

A deductible gift recipient DGR is an organisation or fund that registers to receive tax deductible gifts or donations. We are planning to buy some prizes to raffle to our employees to raise money for a local charity. However raffle tickets are not tax deductible regardless of.

Meaning that those who are married and filing jointly can only get a 300 deduction. Some donations to charity can be claimed as tax deductions on your individual tax return each year. Not all charities are DGRs.

Also if the amount of your contribution depends on the type or size of apartment you will occupy it isnt a charitable contribution. Raffle tickets are not deductible as charitable contributions for federal income tax purposes. The IRS has determined that purchasing the chance to win a prize has value.

Fun Fact Charity Raffle Tickets Are Not Tax Deductible

Are Raffle Tickets Tax Deductible The Finances Hub

Luck Of The Griffin Mega Raffle Fr Mcgivney Catholic High School Glen Carbon Il

Mane Stream 50 50 Raffle Tickets Now On Sale

Are Raffle Tickets Tax Deductible The Finances Hub

Fundraising Events And Cause Related Marketing Pdf Free Download

How To Make Sure Your Charitable Donation Is Tax Deductible Capstone Financial Advisors

Are Charity Donations Tax Deductible A Tax Guide For Giving Picnic

50 50 Raffle Chester County Community Foundation S Blog

2018 Raffle Rules Equality Illinois

Are Charitable Donations Tax Deductible

Muscle Car Raffle For Charity Barky Pines Animal Rescue Sanctuary

Are Nonprofit Raffle Ticket Donations Tax Deductible

Fun Fact Charity Raffle Tickets Are Not Tax Deductible

Ticket Events Set Tax Deductible Amounts Givesignup Blog

Are Nonprofit Raffle Ticket Donations Tax Deductible

How To Make Sure Your Charitable Donation Is Tax Deductible Capstone Financial Advisors