trust capital gains tax rate 2020

The trust deed defines income to include capital gains. Some or all net capital gain may be taxed at 0 if your taxable income is less than or equal to 40400 for single or 80800 for married filing jointly or qualifying widow er.

Tax Form 8949 Instructions For Reporting Capital Gains Losses Capital Gain Capital Gains Tax Tax Forms

For tax year 2021 the 20 rate applies to amounts above 13250.

. Irrevocable trusts have a major tax issue. Capital gains tax rates on most assets held for a year or less correspond to. The tax-free allowance for trusts is.

The trust has the following 2020 sources of income and deduction. Your 2021 Tax Bracket to See Whats Been Adjusted. Payments in respect of original long-term insurance policies.

Interest income 20000. The tax rate on most net capital gain is no higher than 15 for most individuals. Assume there is one beneficiary who files as a single individual and the trust is his or her only income.

Where the capital gain is attributed to the trust the effective rate of tax on a capital gain is 36. The 0 bracket for long-term capital gains is close to the current 10 and 12 tax brackets for ordinary income while the 15 rate for gains corresponds somewhat to the 22 to 35 bracket levels. Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000.

Ad Compare Your 2022 Tax Bracket vs. Trusts pay the highest capital gains tax rate when taxable income exceeds 13150 compared to 441450 for a single individual. The 2020 estimated tax.

265 24 of income over 2650. A capital gain of 200 that is eligible for the CGT 50 discount. The 0 rate applies to amounts up to 2700.

Most personal use assets. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. However long term capital gain generated by a trust still maxes out at 20 plus the 38 when taxable trust income exceeds 13050.

10 of income over 0. It continues to be important to obtain date of death values to support the step up in basis which will reduce the capital gains realized during the trust or estate administration. R2 million gain or loss on the disposal of a primary residence.

Trustees only have to pay Capital Gains Tax if the total taxable gain is above the trusts tax-free allowance called the Annual Exempt Amount. R2 million gain or loss on the disposal of a primary residence. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

Events that trigger a disposal include a sale donation exchange loss death and emigration. At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed with the Affordable Care Act. Individuals 18 2021 2020 Companies 224 2021 2020 Trusts 36 2021 2020 Capital Gains Tax.

If the estate or trust receives its income unevenly throughout the year it may be able to lower or eliminate the. The maximum tax rate for long-term capital gains and qualified dividends is 20. The remaining amount is taxed at the current rate of Capital Gains Tax for trustees in the 2021 to 2022 tax year.

At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed with the Affordable Care Act. Discover Helpful Information and Resources on Taxes From AARP. In 2020 to 2021 a trust.

By Soutry Smith Income Tax. Capital Gain Tax Rates. An individual would have to make over 518500 in taxable income to be taxed at 37.

Ad From Fisher Investments 40 years managing money and helping thousands of families. The 0 and 15 rates continue to apply to amounts below certain threshold amounts. Payments in respect of original long-term insurance policies.

Capital Gains Tax Rate. Although irrevocable trusts are complex trusts which means they can accumulate income they make on trust assets the trustees normally reduce taxes by distributing all the trust income each year. A trustee derived the following amounts in the 201415 income year.

The 0 rate applies up to 2650. Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000. Estates and trusts.

The following are some of the specific exclusions. Trustees only have to pay Capital Gains Tax if the total taxable gain is above the trusts tax-free allowance called the Annual. A capital gain rate of 15 applies if your taxable income is.

They would apply to the tax return filed in 2022. Apr 22 2016 at 1202AM. Most people dont think much about capital gains tax on the sale of a home because the tax laws offer a capital gains exclusion of 250000 to single filers and 500000.

For the 2020 tax year a simple or complex trusts income is taxed at bracket rates of 10 24 35. Below are the tax rates and income brackets that would apply to estates and trusts that were opened for deaths that occurred in 2021. Income and short-term capital gain generated by an irrevocable trust gets taxed at high rates.

It continues to be important to obtain date of death values to support the step up in basis which will reduce the. Events that trigger a disposal include a sale donation exchange loss death and emigration. For tax year 2020 the 20 rate applies to amounts above 13150.

The income of the trust estate is therefore 300 100 interest income 200 capital gain and the net income of the trust is 200 100 interest income. The trustee of an irrevocable trust has discretion to distribute income including capital gains. Events that trigger a disposal include a sale donation exchange loss death and emigration.

At basically 13000 in income they hit the highest tax rate. The maximum tax rate for long-term capital gains and qualified dividends is 20. Trust capital gains tax rate 2020.

How Long Term Capital Gains Stack On Top Of Ordinary Income Tax Fiphysician

Capital Gains Tax On Gifts Low Incomes Tax Reform Group

Capital Gains Tax Relief For Holiday Lets Sykes Holiday Cottages

What Is Investment Income Definition Types And Tax Treatments

Capital Gains Tax Examples Low Incomes Tax Reform Group

Capital Gains Tax What Is It When Do You Pay It

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Capital Gain Tax Calculator 2022 2021

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

How To Reduce Or Avoid Capital Gains Tax On Property Or Investments Capital Gains Tax Real Estate Investing Rental Property Capital Gain

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

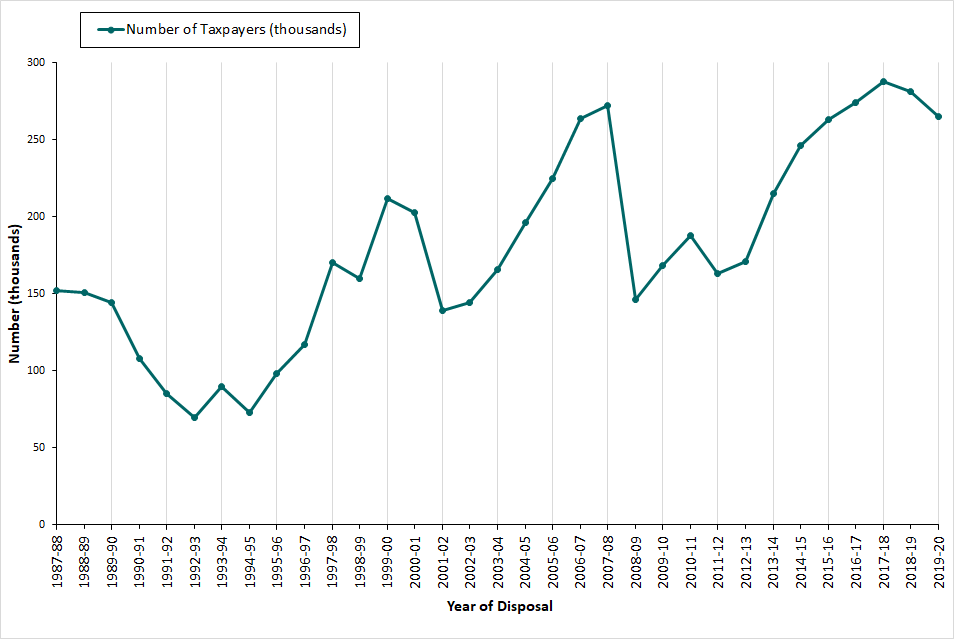

Capital Gains Tax Commentary Gov Uk

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Will Joe Biden S Proposed Taxes On Capital Make America An Outlier The Economist

The States With The Highest Capital Gains Tax Rates The Motley Fool

How Much Is The Capital Gains Tax On Real Estate Ramseysolutions Com

Capital Gains Tax On Shares In Australia Explained Sharesight